¶ Orders

¶ Description:

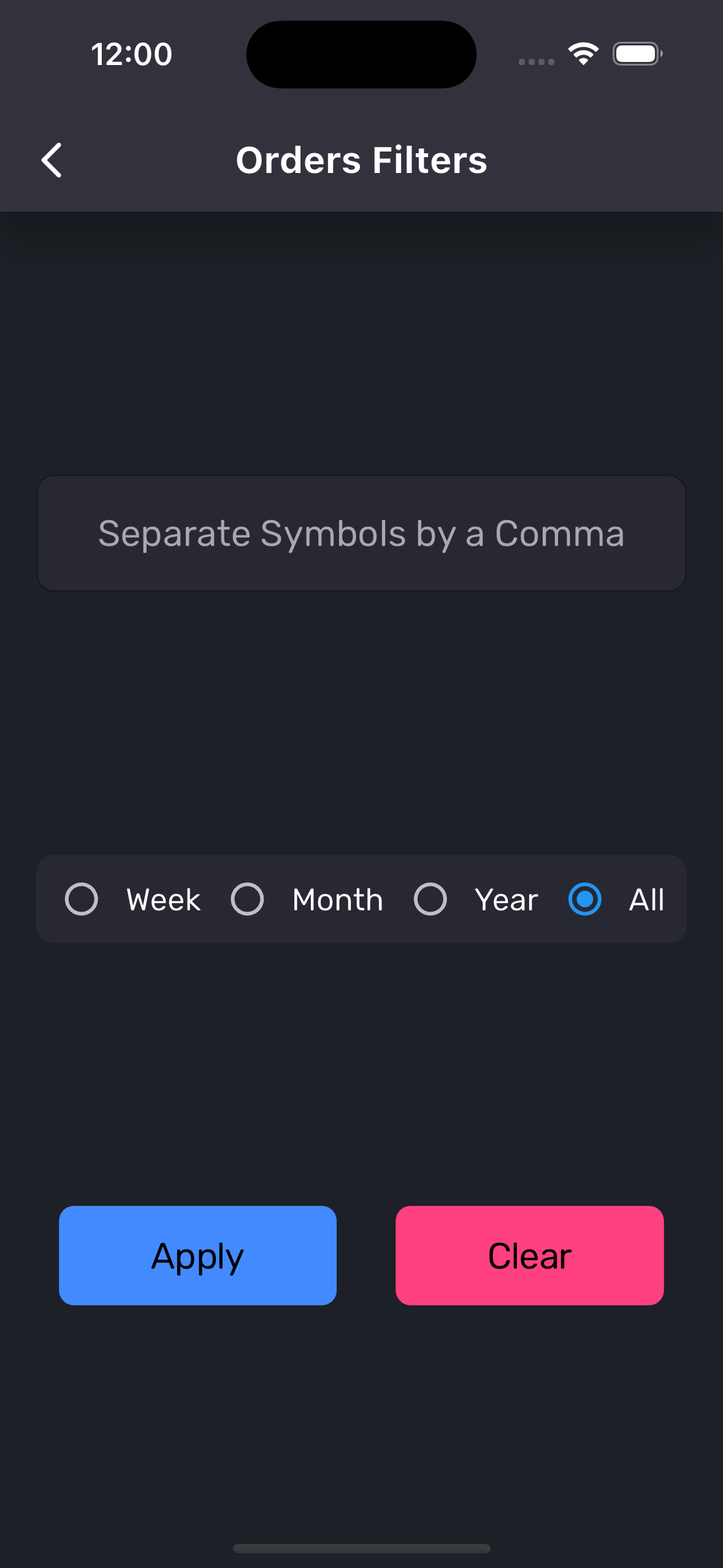

The Orders module provides traders with a centralized view to manage all their active, completed, and cancelled orders efficiently. It helps track real-time order status, view historical transactions, and access detailed reports on multi-leg orders and linked orders, enhancing order management and decision-making processes. Additionally, traders can place new orders using the dynamic order form with real-time price integration.

¶ Key Features:

- View Active, Completed, and Cancelled Orders: Monitor orders in real-time and track their status from placement to execution.

-

Modify or Cancel Open Orders: Easily adjust or cancel pending orders.

-

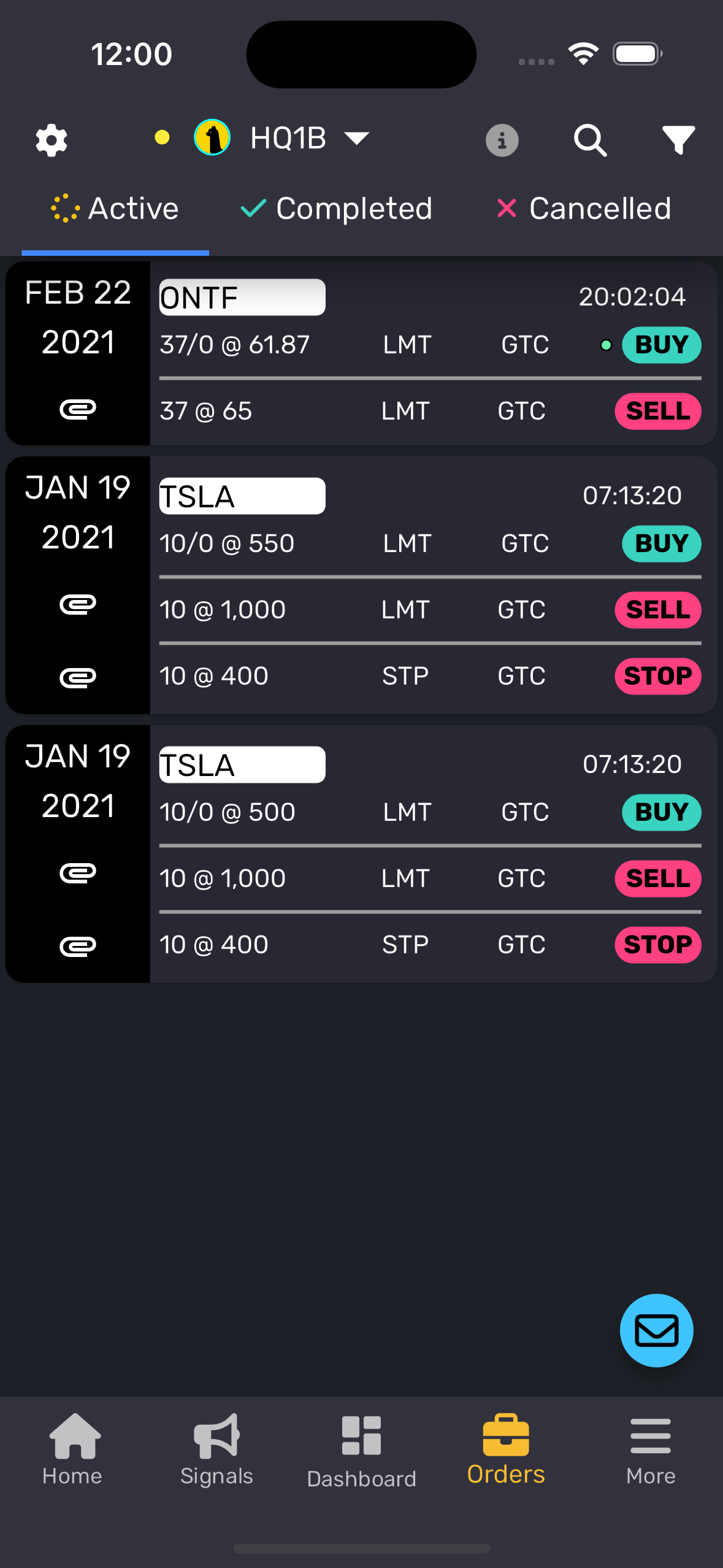

Partial Order and Linked Status: View statuses for multi-leg orders and associated linked orders.

-

Order Journal: Access a local journal of all orders for detailed reference.

-

Real-Time Price Tracking: Monitor price movements for each order as they change in real-time.

-

Detailed Order Information: View specifics like Order ID and status reported by the broker or exchange.

-

Advanced: Allows direct routing to specific exchange based on broker capability.

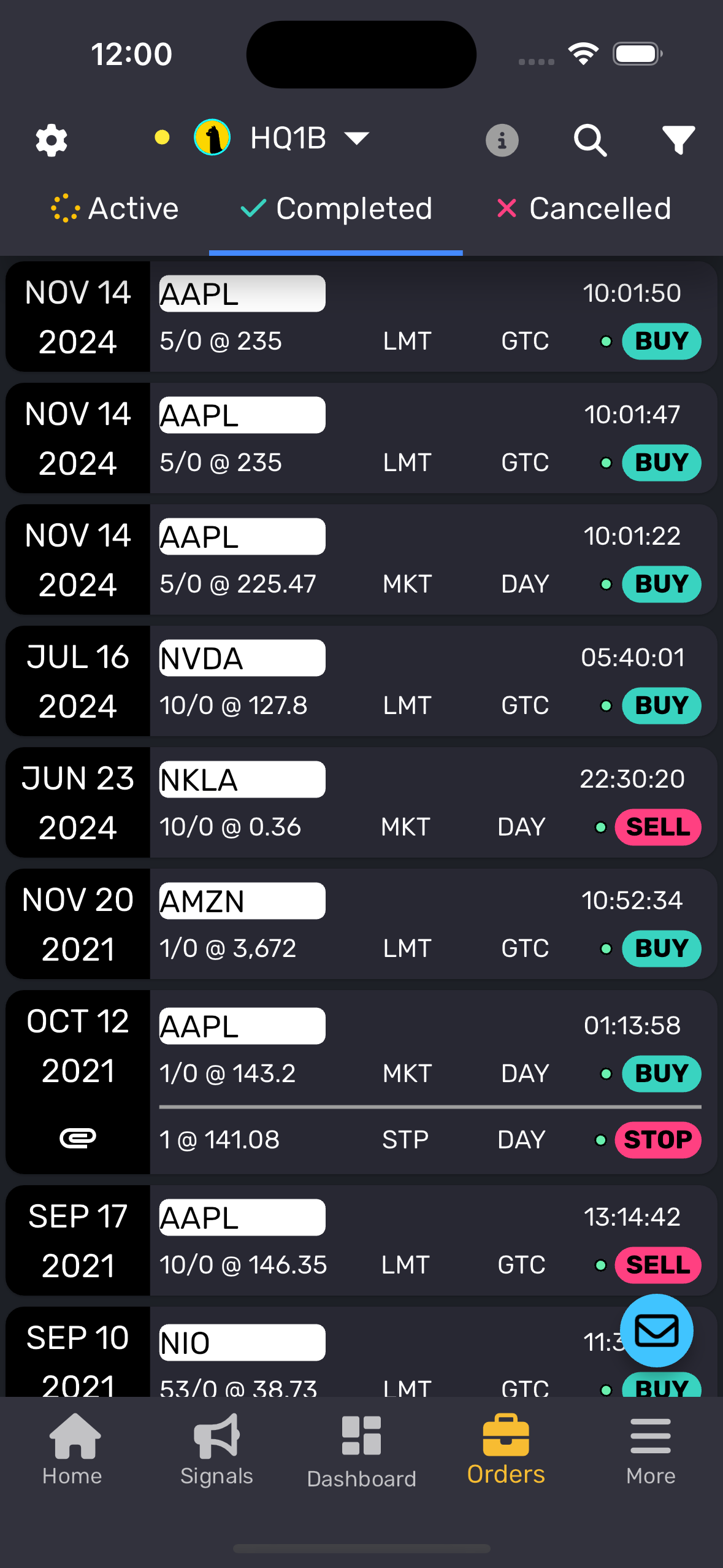

¶ Orders Overview:

- Active Orders: Pending orders waiting to be executed.

- Completed Orders: Orders that were fully executed, including partially completed multi-leg orders.

- Canceled Orders: Orders that were canceled, rejected, or faced an error.

Note: Swipe left on an active order to cancel it. Swipe right to create a similar order or modify the existing order.

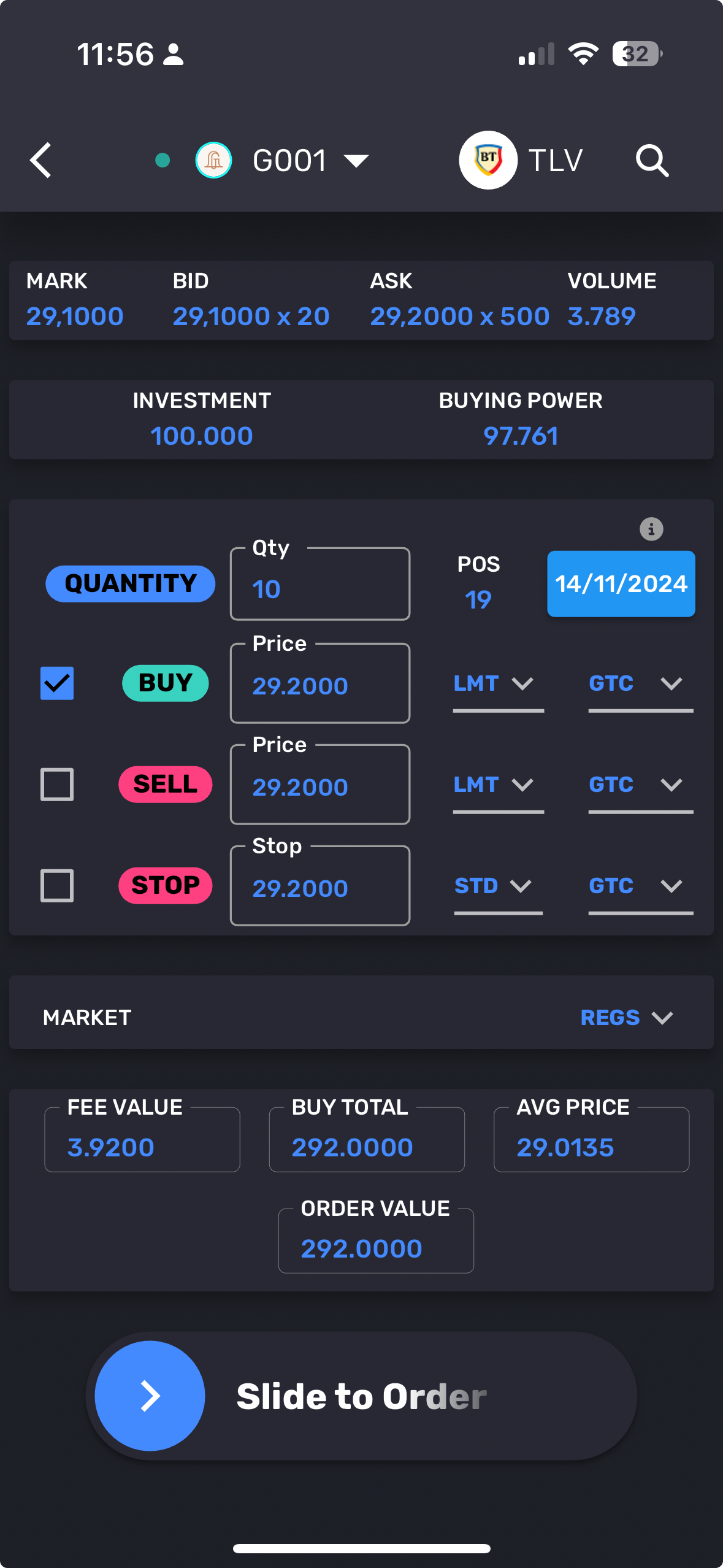

¶ Order Placement

When a user searches for a symbol or clicks on the cart button or Bid/Ask price, the order form is automatically filled with the latest price information, streamlining the order creation process. Users can update the form before submission as needed.

¶ Order Form Details:

-

Quantity (Qty):

- Displays the default quantity from the order settings.

- Users can switch between preset quantities (e.g., 0.75, 0.6, 0.5, 0.25, 0.15) or type in a custom amount.

- POS Button: Displays the current position quantity. Clicking it automatically fills the qty field.

-

Buy Price: Pre-filled with the Ask price by default.

-

Sell Price: Pre-filled with the Bid price and defaults to a 10% profit unless changed via order settings.

-

Stop Price: Pre-filled with the default stop price from the Order Settings.

Note: Users can also manually type in custom buy, sell, or stop prices in their respective fields.

-

Order Types:

- Limit (LMT) and Market Orders are available for buy/sell orders via the dropdown.

- Stop Orders: Configured with Standard (STD) settings.

- Trail Stop: Depends on broker capability

- Multi Leg Orders: Depends on broker capability

-

Time-in-Force (TIF): Users can select the order duration from options like:

- DAY: Order remains active until the end of the trading day.

- GTC: Good-Till-Canceled, meaning the order remains active until manually canceled.

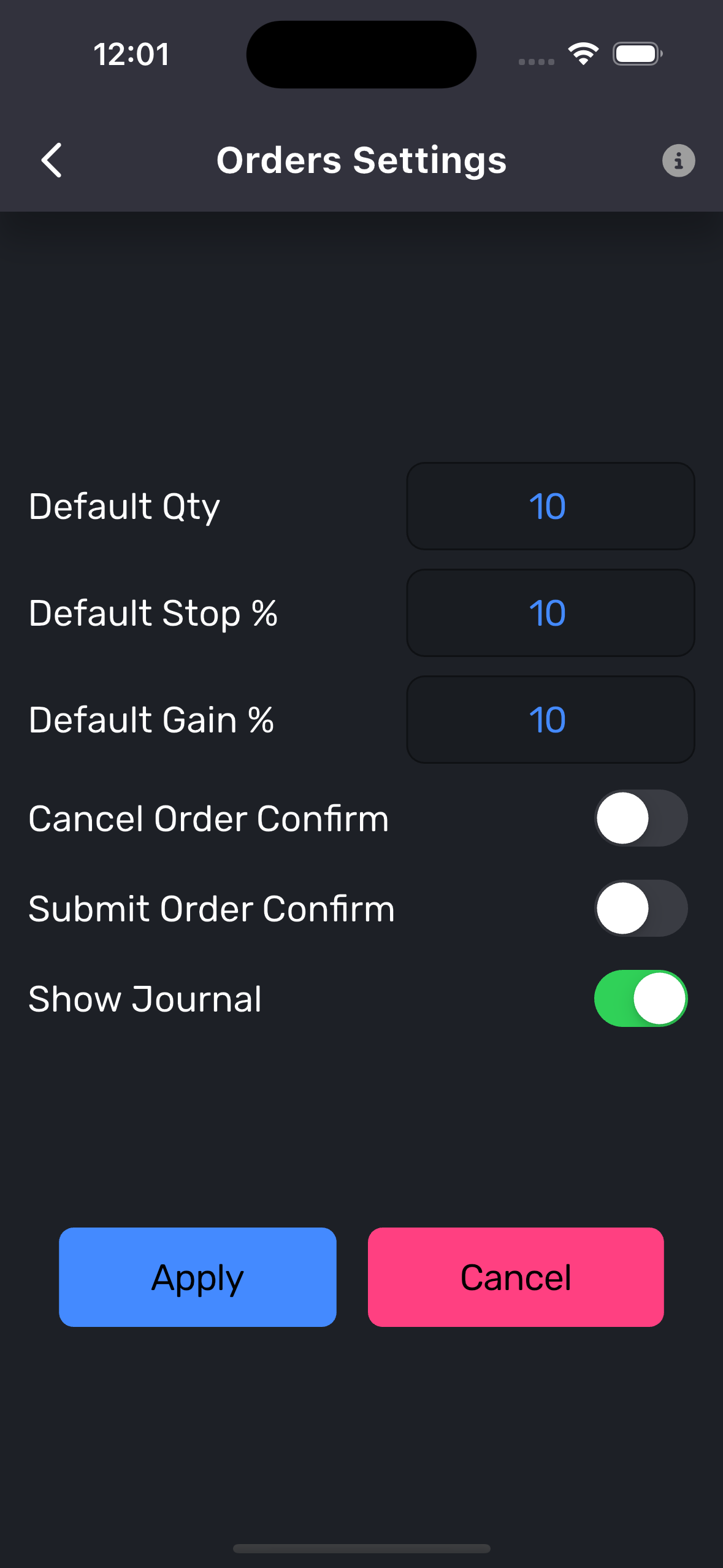

¶ Orders Settings

The Orders Settings section allows users to define default parameters for placing orders quickly and efficiently outside of trades, ensuring consistency in order management.

¶ Default Parameters:

- Default Qty: Pre-set quantity for placing orders.

Default = 10 - Default Stop %: The percentage below the buy price where the stop order should trigger.

Default = 10% - Default Gain %: The percentage above the buy price for a take-profit order.

Default = 10% - Cancel Order Confirm: Toggle to require confirmation before canceling an order.

- Submit Order Confirm: Toggle to require confirmation before submitting a new order.

- Show Journal: Toggle to display or hide the order journal for tracking order history and details.

¶ Additional Features:

- Investment and Available Funds: Displays the user’s current investment amount and available balance for trades.

- Slide to Order: After filling out the order form, users can slide to place the order quickly.

- Order Total: Automatically updates based on the quantity and selected buy/sell prices. Press "Enter" on the quantity field to refresh the total.

¶ Additional Information:

- Efficient Order Management: With swipe actions to quickly modify or cancel orders, managing active trades becomes seamless.

- Customizable Order Settings: The ability to set default quantities, stop percentages, and gain targets ensures consistent trading practices and reduces the chances of input errors.

- Pre-Filled Order Form: The system auto-fills prices and quantity based on the latest market data, saving time during order placement.

- Order Journal: Keeping an order journal accessible helps traders maintain a detailed log of all transactions for future reference and analysis.

Tip: Use the Show Journal option to keep your trade history visible, ensuring better tracking and review of your trading strategies.