¶ Account Rebalancing Guide

Account rebalancing ensures your investments are in alignment with your intended portfolio distribution. This guide walks you through understanding the current positions, reviewing their value breakdown, and executing required rebalancing orders.

¶ Investment Overview

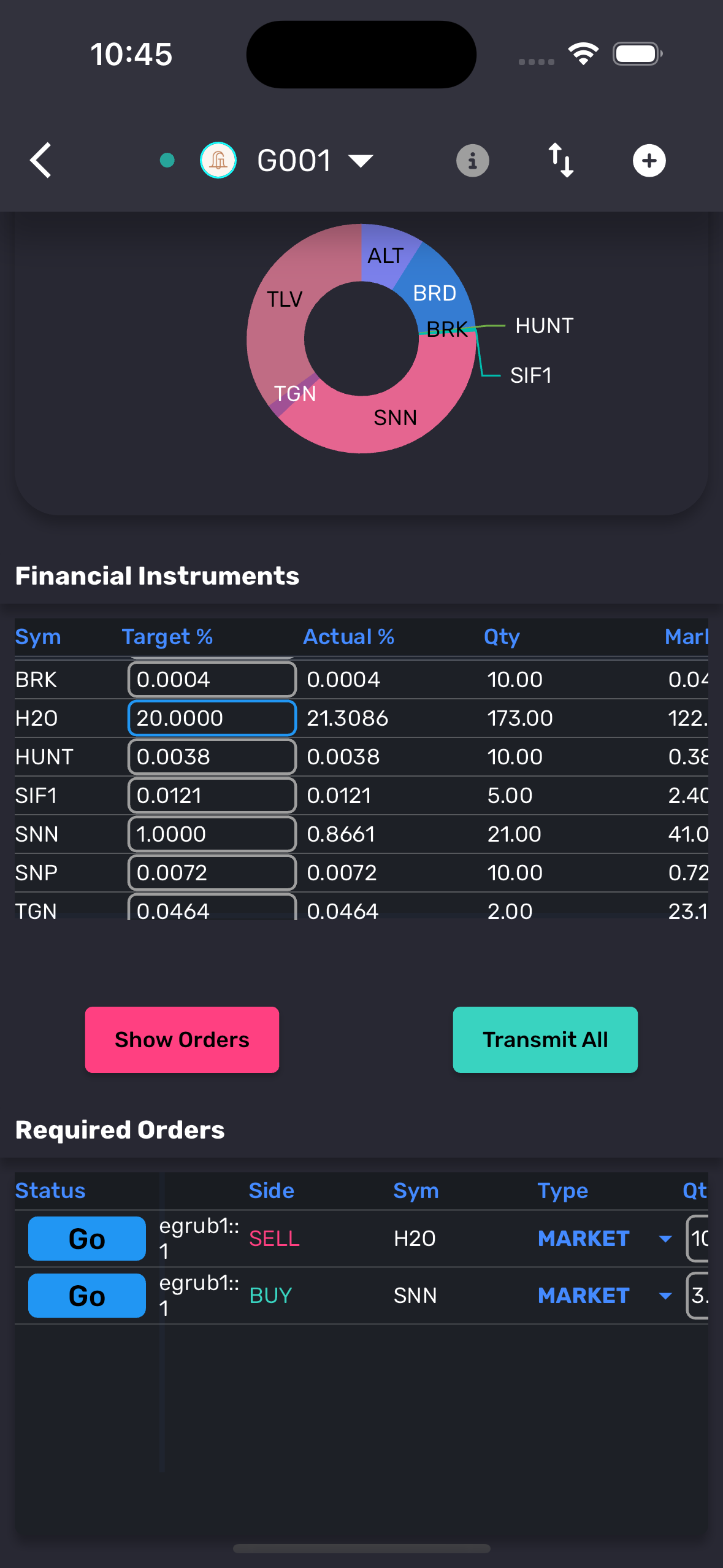

In the example below, an initial investment of $50,000 is distributed across several financial instruments:

¶ Investment Breakdown

The breakdown of the investment is illustrated as follows:

- Investment Amount: $50,000

¶ Financial Instruments (Current Holdings)

| Sym | Qty | Mark | Cost | Current % Allocation | Target % Allocation |

|---|---|---|---|---|---|

| AAPL | 10 | 150.00 | 1500.00 | 3% | 5% |

| AMZN | 5 | 3200.00 | 16000.00 | 32% | 20% |

| GOOGL | 20 | 2800.00 | 56000.00 | 56% | 50% |

| MSFT | 15 | 299.99 | 4499.85 | 4% | 10% |

| TSLA | 8 | 900.00 | 7200.00 | 5% | 10% |

| Cash | - | - | 5000.00 | 5% | 5% |

The values represent current quantities, market values, total cost per instrument, current percentage allocation, and the target percentage allocation that the user wishes to achieve.

¶ Rebalancing Requirements

The next section outlines the orders needed to rebalance the portfolio to achieve the desired target allocation. These orders can involve buying or selling instruments to adjust the distribution appropriately.

¶ Required Orders

| Status | I | Sym | Qty | Price | Type | Time |

|---|---|---|---|---|---|---|

| Go | BUY | AAPL | 10 | 150.00 | Market | 12:34:56 |

| Go | SELL | AMZN | 5 | 3200.00 | Limit | 14:23:45 |

| Go | BUY | GOOGL | 20 | 2800.00 | Market | 10:12:34 |

| Go | SELL | MSFT | 15 | 299.99 | Limit | 16:50:34 |

| Go | BUY | TSLA | 8 | 900.00 | Market | 09:30:15 |

The Go button is used to send each specific order individually. The status indicates the actions needed to achieve the rebalanced portfolio. Orders should be transmitted as indicated, ensuring alignment with target values.

¶ How to Transmit Orders

- Press the Refresh button to update any changes in the market values.

- Press the Transmit All button to execute all required orders for rebalancing.

¶ Example Summary

In this example, specific actions are required to achieve portfolio rebalancing. Using the Transmit All option ensures that all required orders are executed, leading to alignment with the desired target allocations for each financial instrument.